Where To Write Exempt On W4 2025

Where To Write Exempt On W4 2025. They earn less than $12,500. You still need to complete steps 1 and 5.

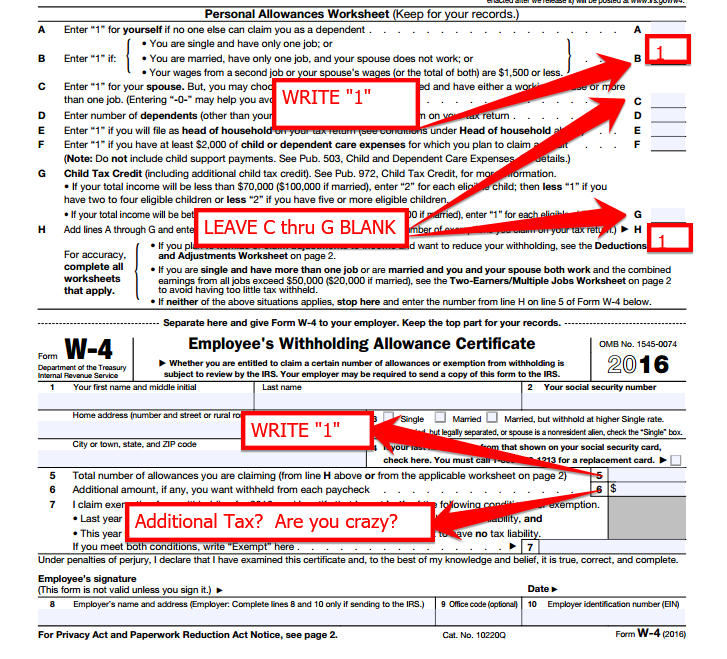

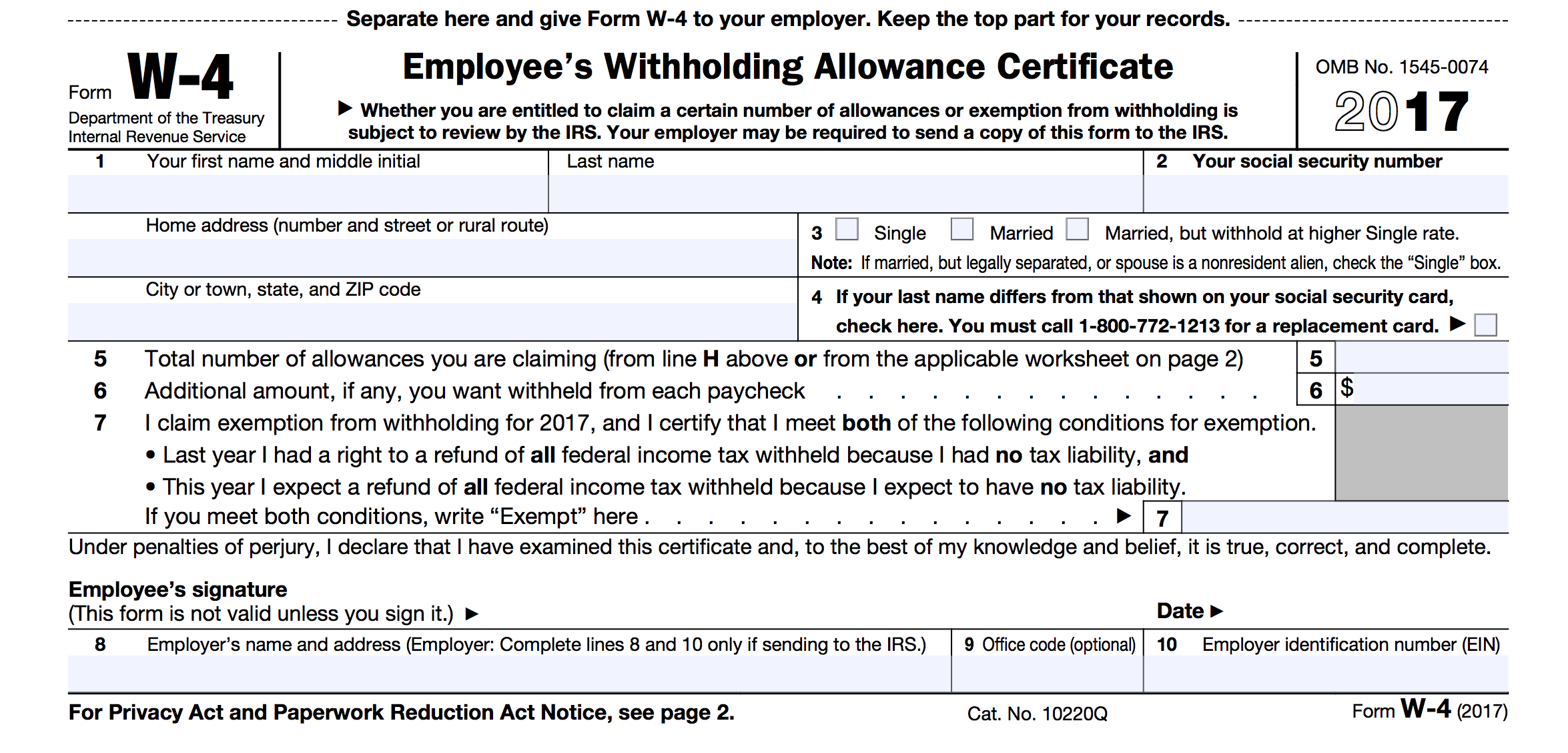

In box 7, you will need to write “exempt”. I just noticed my employer isn’t taking out federal taxes and has me as exempt.

There Isn't A Particular Line For This On The Form, But You Can Claim An Exemption By Writing Exempt In The Space Below Line 4(C) If You Qualify.

Based on a number of allowances and exemptions you claim, your.

In Box 7, You Will Need To Write “Exempt”.

Avoid filling out any other.

Where To Write Exempt On W4 2025 Images References :

Source: www.pinterest.co.uk

Source: www.pinterest.co.uk

W4 Exemption In Taxes Tax rules, Tax, Tax preparation, This is because you are starting to work so late into the year, that you won't owe enough to owe federal taxes. In box 7, you will need to write “exempt”.

Source: www.wikihow.life

Source: www.wikihow.life

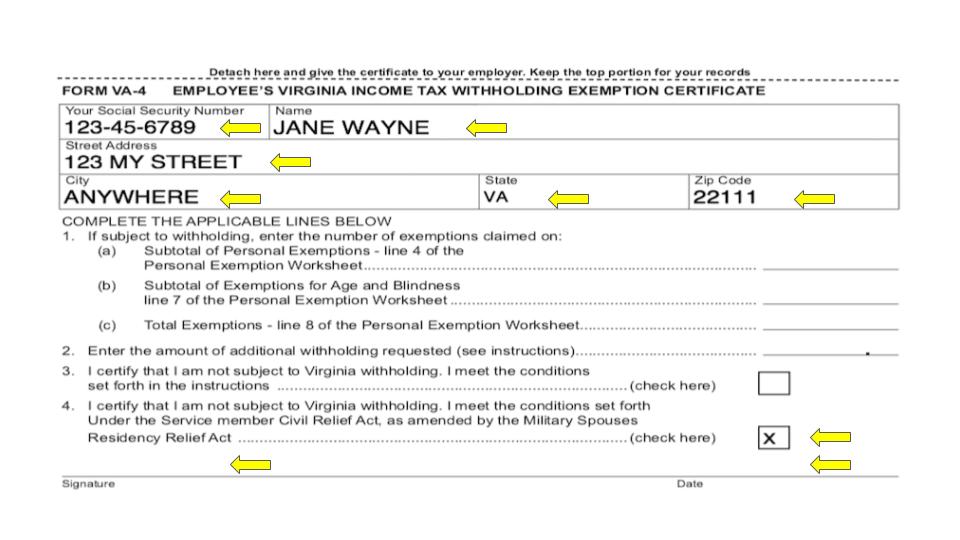

3 Ways to File As Exempt on a W4 wikiHow Life, (in box 7, write “exempt”. How to claim an exemption from withholding.

Source: www.wikihow.life

Source: www.wikihow.life

3 Ways to File As Exempt on a W4 wikiHow Life, Based on a number of allowances and exemptions you claim, your. In box 7, you will need to write “exempt”.

Source: nicolawellen.pages.dev

Source: nicolawellen.pages.dev

How To Fill Out W4 Form Exempt 2025 Essa Malanie, No federal income tax liability in the previous year and an expectation of no income tax in the. Avoid filling out any other.

Source: classfullturfites.z13.web.core.windows.net

Source: classfullturfites.z13.web.core.windows.net

How Allowances Work On W4, This is not the same as a personal exemption or a dependent exemption, which the tax cuts. Then, just finish steps 1 and 5.

Source: www.ingramfinancialmanagement.com

Source: www.ingramfinancialmanagement.com

How to Complete Forms W4 Attiyya S. Ingram, AFC®, MQFP®, You have to have no tax liability, which would mean you make less than $14k a year. When i brought it to their attention they said i must’ve accidentally checked the.

Source: templates.udlvirtual.edu.pe

Source: templates.udlvirtual.edu.pe

Free Printable W 4 Form For Employees Printable Templates, You sound like you can put exempt on your federal tax return, yes. This is because you are starting to work so late into the year, that you won't owe enough to owe federal taxes.

Source: www.thinglink.com

Source: www.thinglink.com

W4 Form, No federal income tax liability in the previous year and an expectation of no income tax in the. You sound like you can put exempt on your federal tax return, yes.

Source: www.youtube.com

Source: www.youtube.com

IRS FORM W4 Exemptions 2022 YouTube, How to claim an exemption from withholding. Also, an exemption is only good for one year.

Source: www.youtube.com

Source: www.youtube.com

How To Fill Out W4 Tax Form In 2022 FAST UPDATED YouTube, This is not the same as a personal exemption or a dependent exemption, which the tax cuts. How to claim an exemption from withholding.

(In Box 7, Write “Exempt”.

Updated for 2025 (and the taxes you do in 2025), simply enter your tax information and adjust your.

Based On A Number Of Allowances And Exemptions You Claim, Your.

Or $25,100 in total if they are married and file jointly.

Category: 2025